Impurity-Based Important Features for feature selection in Recursive Feature Elimination for Stock Price Forecasting

Fitur Penting Berbasis Impurity untuk pemilihan fitur dalam Recursive Feature Elimination untuk Peramalan Harga Saham

DOI:

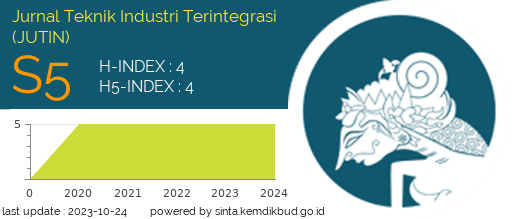

https://doi.org/10.31004/jutin.v6i4.17726Keywords:

Important Features, Impurity, Recursive Feature Elimination, Various Moving Averages, Machine LearningAbstract

Stock investors perform stock price forecasting based on technical indicators and historical stock prices. The large number of technical indicators and historical data often leads to overfitting and ambiguity in forecasting using machine learning. In this paper, we proposed a feature selection approach using impurity-based important features in recursive feature elimination for stock price forecasting. The data utilized includes historical data and various moving averages. Feature selection is employed to reduce the number of features and obtain important and relevant features. The recursive feature elimination with impurity-based important features is utilized as the feature selection method. The machine learning methods employed are linear regression, support vector regression, multi-layer perceptron regression, and random forest regression. The measurement results of mean squared error (mse), root mean squared error (rmse), mean absolute error (mae), and mean absolute percentage error (mape) show that the optimal feature selection and machine learning method is achieved with six features and linear regression. The average mse, rmse, mae, and mape values are 0.000279, 0.016577, 0.012843, and 1.42236%, respectively. These results validate the effectiveness of impurity-based important features for feature selection in recursive feature elimination using historical data and various moving averages in stock price forecasting.References

Albahli, S., Nazir, T., Mehmood, A., Irtaza, A., Alkhalifah, A., & Albattah, W. (2022). AEI-DNET: A Novel DenseNet Model with an Autoencoder for the Stock Market Predictions Using Stock Technical Indicators. Electronics (Switzerland), 11(4), 611. https://doi.org/10.3390/electronics11040611

Ampomah, E. K., Nyame, G., Qin, Z., Addo, P. C., Gyamfi, E. O., & Gyan, M. (2021). Stock Market Prediction with Gaussian Naïve Bayes Machine Learning Algorithm. Informatica, 45(2), 243–256. https://doi.org/10.31449/inf.v45i2.3407

Ayyappa, Y., & Siva Kumar, A. P. (2023). Optimized long short-term memory-based stock price prediction with sentiment score. Social Network Analysis and Mining, 13(1), 13. https://doi.org/10.1007/s13278-022-01004-5

Azimifar, M., Araabi, B. N., & Moradi, H. (2020). Forecasting stock market trends using support vector regression and perceptually important points. 2020 10th International Conference on Computer and Knowledge Engineering (ICCKE), 268–273. https://doi.org/10.1109/ICCKE50421.2020.9303667

Azizah, M., Irawan, M. I., & Putri, E. R. M. (2020). Comparison of stock price prediction using geometric Brownian motion and multilayer perceptron. AIP Conference Proceedings, 2242(May), 030016. https://doi.org/10.1063/5.0008066

Basak, S., Kar, S., Saha, S., Khaidem, L., & Dey, S. R. (2019). Predicting the direction of stock market prices using tree-based classifiers. The North American Journal of Economics and Finance, 47, 552–567. https://doi.org/10.1016/j.najef.2018.06.013

Bhuriya, D., Kaushal, G., Sharma, A., & Singh, U. (2017). Stock market predication using a linear regression. 2017 International Conference of Electronics, Communication and Aerospace Technology (ICECA), 510–513. https://doi.org/10.1109/ICECA.2017.8212716

Bouktif, S., Fiaz, A., & Awad, M. (2019). Stock Market Movement Prediction using Disparate Text Features with Machine Learning. 2019 Third International Conference on Intelligent Computing in Data Sciences (ICDS), 1–6. https://doi.org/10.1109/ICDS47004.2019.8942303

Chandrika, P. V., & Srinivasan, K. S. (2021). Predicting Stock Market Movements Using Artificial Neural Networks. Universal Journal of Accounting and Finance, 9(3), 405–410. https://doi.org/10.13189/ujaf.2021.090315

Charan, V. S., Rasool, A., & Dubey, A. (2022). Stock Closing Price Forecasting using Machine Learning Models. 2022 International Conference for Advancement in Technology, ICONAT 2022. https://doi.org/10.1109/ICONAT53423.2022.9725964

Chauhan, K., & Sharma, N. (2023). Study of Linear Regression Prediction Model for American Stock Market Prediction. In Advances in Transdisciplinary Engineering (Vol. 32, pp. 406–411). https://doi.org/10.3233/ATDE221289

Deshmukh, R. A., Jadhav, P., Shelar, S., Nikam, U., Patil, D., & Jawale, R. (2023). Stock Price Prediction Using Principal Component Analysis and Linear Regression. Lecture Notes in Networks and Systems, 490, 269–276. https://doi.org/10.1007/978-981-19-4052-1_28

Fang, Y. (2020). Stock Price Forecasting Based on Improved Support Vector Regression. Proceedings - 2020 7th International Conference on Information Science and Control Engineering, ICISCE 2020, 1351–1354. https://doi.org/10.1109/ICISCE50968.2020.00272

Ghosh, P., Neufeld, A., & Sahoo, J. K. (2022). Forecasting directional movements of stock prices for intraday trading using LSTM and random forests. Finance Research Letters, 46, 102280. https://doi.org/10.1016/j.frl.2021.102280

Hamzah, S. R., Halul, H., Jeng, A., & Umul Ain’syah Sha’ari. (2021). Forecasting Nestle Stock Price by using Brownian Motion Model during Pandemic Covid-19. Malaysian Journal of Science Health & Technology, 7(2), 58–64. https://doi.org/10.33102/mjosht.v7i2.214

Huang, Y., Deng, C., Zhang, X., & Bao, Y. (2022). Forecasting of stock price index using support vector regression with multivariate empirical mode decomposition. Journal of Systems and Information Technology, 24(2), 75–95. https://doi.org/10.1108/JSIT-12-2019-0262

Illa, P. K., Parvathala, B., & Sharma, A. K. (2022). Stock price prediction methodology using random forest algorithm and support vector machine. Materials Today: Proceedings, 56, 1776–1782. https://doi.org/10.1016/j.matpr.2021.10.460

Ji, Y., Liew, A. W.-C., & Yang, L. (2021). A Novel Improved Particle Swarm Optimization With Long-Short Term Memory Hybrid Model for Stock Indices Forecast. IEEE Access, 9, 23660–23671. https://doi.org/10.1109/ACCESS.2021.3056713

K, P., Rudagi, S., M, N., Patil, R., & Wadi, R. (2021). Comparative Study: Stock Prediction Using Fundamental and Technical Analysis. 2021 IEEE International Conference on Mobile Networks and Wireless Communications (ICMNWC), 1–4. https://doi.org/10.1109/ICMNWC52512.2021.9688449

Kehinde, T. O. O., Chan, F. T. S., & Chung, S. H. H. (2023). Scientometric review and analysis of recent approaches to stock market forecasting: Two decades survey. Expert Systems with Applications, 213, 119299. https://doi.org/10.1016/j.eswa.2022.119299

Kumar, G., Jain, S., & Singh, U. P. (2021). Stock Market Forecasting Using Computational Intelligence: A Survey. Archives of Computational Methods in Engineering, 28(3), 1069–1101. https://doi.org/10.1007/s11831-020-09413-5

Lavingia, K., Khanpara, P., Mehta, R., Patel, K., & Kothari, N. (2022). Predicting Stock Market Trends using Random Forest: A Comparative Analysis. 2022 7th International Conference on Communication and Electronics Systems (ICCES), 1544–1550. https://doi.org/10.1109/ICCES54183.2022.9835876

Lee, M.-C., Chang, J.-W., Yeh, S.-C., Chia, T.-L., Liao, J.-S., & Chen, X.-M. (2022). Applying attention-based BiLSTM and technical indicators in the design and performance analysis of stock trading strategies. Neural Computing and Applications, 34(16), 13267–13279. https://doi.org/10.1007/s00521-021-06828-4

Ma, Y., Mao, R., Lin, Q., Wu, P., & Cambria, E. (2023). Multi-source aggregated classification for stock price movement prediction. Information Fusion, 91, 515–528. https://doi.org/10.1016/j.inffus.2022.10.025

Meghana, N., & Arumugam, S. S. (2023). Use Novel Naive Bayes to Predict Stock Market Movement and Compare Prediction Accuracy to Linear Regression . Journal of Survey in Fisheries Sciences, 10(1S), 2874–2882. http://sifisheriessciences.com/journal/index.php/journal/article/view/520

Namdari, A., & Durrani, T. S. (2021). A Multilayer Feedforward Perceptron Model in Neural Networks for Predicting Stock Market Short-term Trends. Operations Research Forum, 2(3), 38. https://doi.org/10.1007/s43069-021-00071-2

Pandya, J. B., & Jaliya, U. K. (2022). An empirical study on the various stock market prediction methods. Register: Jurnal Ilmiah Teknologi Sistem Informasi, 8(1), 58–80. https://doi.org/10.26594/register.v8i1.2533

Park, H. J., Kim, Y., & Kim, H. Y. (2022). Stock market forecasting using a multi-task approach integrating long short-term memory and the random forest framework. Applied Soft Computing, 114, 108106. https://doi.org/10.1016/j.asoc.2021.108106

Ray, R., Khandelwal, P., & Baranidharan, B. (2018). A Survey on Stock Market Prediction using Artificial Intelligence Techniques. 2018 International Conference on Smart Systems and Inventive Technology (ICSSIT), 594–598. https://doi.org/10.1109/ICSSIT.2018.8748680

Sundar, G., & Satyanarayana, K. (2019). Multi Layer Feed Forward Neural Network Knowledge Base to Future Stock Market Prediction. International Journal of Innovative Technology and Exploring Engineering, 8(11S), 1061–1075. https://doi.org/10.35940/ijitee.K1218.09811S19

Vijh, M., Chandola, D., Tikkiwal, V. A., & Kumar, A. (2020). Stock Closing Price Prediction using Machine Learning Techniques. Procedia Computer Science, 167(2019), 599–606. https://doi.org/10.1016/j.procs.2020.03.326

Xia, Y., Liu, Y., & Chen, Z. (2013). Support Vector Regression for prediction of stock trend. 2013 6th International Conference on Information Management, Innovation Management and Industrial Engineering, 123–126. https://doi.org/10.1109/ICIII.2013.6703098

Yeo, L. L. X., Cao, Q., & Quek, C. (2023). Dynamic portfolio rebalancing with lag-optimised trading indicators using SeroFAM and genetic algorithms. Expert Systems with Applications, 216, 119440. https://doi.org/10.1016/j.eswa.2022.119440

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Arif Mudi Priyatno, Wahyu Febri Sudirman, R. Joko Musridho, Fazilla Amalia

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.