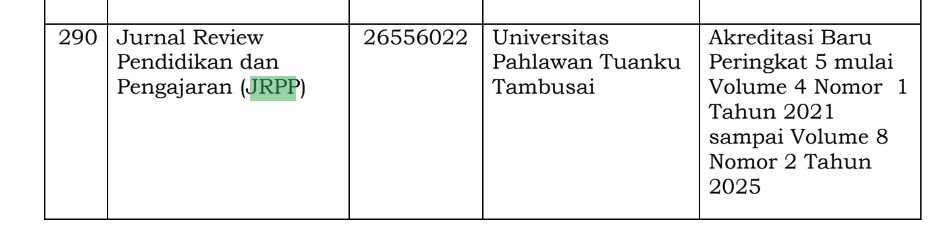

A BIBLIOMETRIC ANALYSIS OF THE TERM “ISLAMIC SOCIAL REPORT”: RESEARCH CLASSIFICATION, RESEARCH TRENDS AND FUTURE DIRECTIONS

DOI:

https://doi.org/10.31004/jrpp.v7i2.27377Keywords:

Islamic Social Report, Bibliometric Analysis, Research TrendsAbstract

This bibliometric analysis delves into the dynamic landscape of "Islamic Social Report" research, offering insights into the diverse themes and trends within the intersection of Islamic principles and social reporting practices. Through the classification of research clusters, exploration of temporal trends, and examination of citation metrics, the study provides valuable guidance for researchers, policymakers, and practitioners engaged in the realm of Islamic social reporting. However, limitations related to database selection and language bias are acknowledged. Future research opportunities include more inclusive analyses across diverse databases and languages, along with a deeper exploration of specific thematic areas within Islamic social reporting. This study serves as a roadmap for navigating the complexities of the field and informs strategic decision-making for sustainable development within Islamic principles.References

Akhter, A., Javed, M. Y., & Akhter, J. (2023). Research trends in the field of Islamic social finance: a bibliometric analysis from 1914 to 2022. International Journal of Ethics and Systems.

Anas, E., & Mounira, B. A. (2009). Ethical investment and the social responsibilities of the Islamic banks. International Business Research, 2(2), 123–130.

Antonio, M. S., Rusydiana, A. S., & Firmansyah, I. (2021). Review on Islamic Social Reporting (ISR) Research. Library Philosophy & Practice.

Fadilah, F. S., & Irianto, B. S. (2023). Disclosure of Islamic Social Reporting at Sharia Banks in Indonesia. Proceeding of International Students Conference on Accounting and Business, 2(1).

Ismail, N., & Aisyah, S. (2021). Islamic Social Finance: A Bibliometric Analysis. Global Review of Islamic Economics and Business, 9(2), 19–28.

Jihadi, M., Vilantika, E., Widagdo, B., Sholichah, F., & Bachtiar, Y. (2021). Islamic social reporting on value of the firm: Evidence from Indonesia Sharia Stock Index. Cogent Business & Management, 8(1), 1920116.

Maali, B., Casson, P., & Napier, C. (2006). Social reporting by Islamic banks. Abacus, 42(2), 266–289.

Marzuki, M. M., Majid, W. Z. N. A., & Rosman, R. (2023). Corporate social responsibility and Islamic social finance impact on banking sustainability post-COVID-19 pandemic. Heliyon, 9(10).

Maulina, R., Dhewanto, W., & Faturrahman, T. (2023). The integration of Islamic social and commercial finance (IISCF): Systematic literature review, bibliometric analysis, conceptual framework, and future research opportunities. Heliyon.

Meutia, I., & Febrianti, D. (2017). Islamic social reporting in Islamic banking: Stakeholders theory perspective. SHS Web of Conferences, 34, 12001.

Mufidah, I. S., Ulum, I., Oktavendi, T. W., Mawardi, F. D., & Afrizal, F. (2023). Islamic Social Reporting and Financial Performance: A Bibliometric Analysis. Dinasti International Journal of Economics, Finance & Accounting, 4(4), 570–576.

Naceur, M. S. Ben, Barajas, M. A., & Massara, M. A. (2015). Can Islamic banking increase financial inclusion? International Monetary Fund.

Nasution, A. A., Lubis, A. F., & Fachrudin, K. A. (2019). Sharia compliance and Islamic social reporting on financial performance of the indonesian sharia banks. 1st Aceh Global Conference (AGC 2018), 640–644.

Rashid, A., & Ghazi, M. S. (2021). Factors affecting Shar??ah audit quality in Islamic banking institutions of Pakistan: a theoretical framework. Islamic Economic Studies, 28(2), 124–140. https://doi.org/10.1108/IES-07-2020-0025

Wijayanti, R., & Setiawan, D. (2022). Social reporting by Islamic Banks: The role of sharia supervisory board and the effect on firm performance. Sustainability, 14(17), 10965.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Elis Mediawati

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.