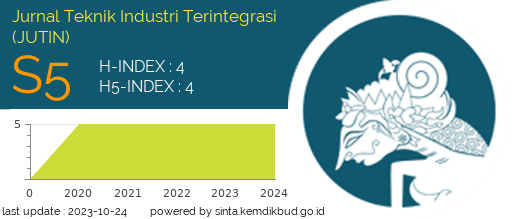

The Effect of Overconfidence Bias on Investment Decision: Sharia Stock Considerations

DOI:

https://doi.org/10.31004/jutin.v7i2.26091Keywords:

over-estimate, over-precision, over-placement, overconfidence, investment decisionAbstract

Investment decisions are a complex process involving risk evaluation, market analysis, and investment return projections. In the decision-making process, investors sometimes show irrational behavior because they have cognitive limitations and previous investment experience so investors are exposed to overconfident behavior. This research used 178 samples consisting of investors who had investment experience of at least 1 year. The research carried out instrument testing and used the common method bias (CMB) testing procedure. The analytical method in the research uses simple linear regression. The results of testing the research hypothesis obtained positive and significant results of overconfidence bias towards irrational investment decisions The moderating role of sharia sharia considerations on the relationship between overconfidence bias and unsupported investment decisions. This research reveals that overconfidence can have a positive influence on irrational investment decision-making. Investors who tend to have excess confidence in their knowledge and skills in analyzing the market tend to make investment decisions that are more impulsive, less rational and sometimes ignore risks significantly. Future research is recommended to further investigate the mechanisms behind the relationship between overconfidence and irrational investment decision-making, as well as involving a wider sample to obtain stronger generalizations.References

Asri, M. (2013). Keuangan Keprilakuan. (fist). BPFE.

Athur, A. D. (2013). Effect of Behavioural Biases on Investment Decisions of Individual Investors in Kenya Abdulahi [University of Nairobi]. In Telematics and Informatics (Vol. 19, Issue 1). https://doi.org/10.1016/j.tele.2017.04.002%0Ahttp://dx.doi.org/10.1016/j.tele.2015.04.013%0Ahttp://dx.doi.org/10.1080/17512786.2013.766062%0Ahttp://dx.doi.org/10.1080/17512786.2016.1221737%0Ahttp://www.hurriyetdailynews.com/timeline-of-gezi-park-protests-

Bakar, S., & Yi, A. N. C. (2016). The Impact of Psychological Factors on Investors’ Decision Making in Malaysian Stock Market: A Case of Klang Valley and Pahang. Procedia Economics and Finance, 35(October 2015), 319–328. https://doi.org/10.1016/s2212-5671(16)00040-x

Barber, B. M., & Odean, T. (2000). Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. The Journal of Finance, 55(2), 773–806. https://doi.org/10.2139/ssrn.219228

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. Quarterly Journal of Economics, 116(1), 261–292. https://doi.org/10.1162/003355301556400

Bashir, T., Javed, A., Usman, A., Meer, U. I., & Naseem, M. M. (2013). Empirical testing of heuristics interrupting the investor’s rational decision making. European Scientific Journal, 9(28).

Bikhchandani, S., Hirshleifer, D., & Welch, I. (1992). A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy, 100(5), 992–1026. https://doi.org/10.1086/261849

Caselli, S., & Negri, G. (2018). Front Matter. In S. Ikeda (Ed.), Private Equity and Venture Capital in Europe (Second). Candice Janco. https://doi.org/10.1016/b978-0-12-812254-9.09991-5

Chen, G., Kim, K. A., Nofsinger, J. R., & Rui, O. M. (2007). Trading Performance, Disposition Effect, Overconfidence, Representativeness Bias, and Experience of Emerging Market Investors. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.957504

Cupák, A., Fessler, P., & Schneebaum, A. (2021). Gender differences in risky asset behavior: The importance of self-confidence and financial literacy. Finance Research Letters, 42(October), 101880. https://doi.org/10.1016/j.frl.2020.101880

Estes, R., & Hosseini, J. (1988). The gender gap on wall street: An empirical analysis of confidence in investment decision making. Journal of Psychology: Interdisciplinary and Applied, 122(6), 577–590. https://doi.org/10.1080/00223980.1988.9915532

Hair, J. F. J., Black, W. C., Babin, B. J., & Anderson, R. E. (2019). Multivariate Data Analysis (Eighth). Pearson Education, Inc. https://doi.org/10.1002/9781119409137.ch4

Hoffmann, A. O. I., & Post, T. (2016). How does investor confidence lead to trading? Linking investor return experiences, confidence, and investment beliefs. Journal of Behavioral and Experimental Finance, 12, 65–78. https://doi.org/10.1016/j.jbef.2016.09.003

Ising, A. (2007). Pompian, M. (2006): Behavioral Finance and Wealth Management – How to Build Optimal Portfolios That Account for Investor Biases. In Financial Markets and Portfolio Management (Vol. 21, Issue 4). Wiley. https://doi.org/10.1007/s11408-007-0065-3

Kafayat, A. (2014). Interrelationship of biases: effect investment decisions ultimately. Theoretical & Applied Economics, 21(6).

Kartini, K., & Nugraha, N. F. (2015). Pengaruh Illusions of Control, Overconfidence Dan Emotion Terhadap Pengambilan Keputusan Investasi Pada Investor Di Yogyakarta. Jurnal Inovasi Dan Kewirausahaan, 4(2), 114–122. https://doi.org/10.20885/ajie.vol4.iss2.art6

Kasoga, P. S. (2021). Heuristic biases and investment decisions: multiple mediation mechanisms of risk tolerance and financial literacy—a survey at the Tanzania stock market. Journal of Money and Business, 1(2), 102–116. https://doi.org/10.1108/jmb-10-2021-0037

Kengatharan, L., & Kengatharan, N. (2014). The Influence of Behavioral Factors in Making Investment Decisions and Performance: Study on Investors of Colombo Stock Exchange, Sri Lanka. Asian Journal of Finance & Accounting, 6(1), 1. https://doi.org/10.5296/ajfa.v6i1.4893

Kock, N. (2022). WarpPLS user manual?: Version 7.0. ScriptWarp Systems, 1–122.

Malhotra, N. K., Kim, S. S., & Patil, A. (2006). Common method variance in IS research: A comparison of alternative approaches and a reanalysis of past research. Management Science, 52(12), 1865–1883. https://doi.org/10.1287/mnsc.1060.0597

Merton, R. C. (1987). A Simple Model of Capital Market Equilibrium with Incomplete Information. The Journal of Finance, 42(3), 483–510. https://doi.org/10.1111/j.1540-6261.1987.tb04565.x

Moore, D. A., & Healy, P. J. (2008). The Trouble With Overconfidence. Psychological Review, 115(2), 502–517. https://doi.org/10.1037/0033-295X.115.2.502

Moore, D. A., & Schatz, D. (2017). The three faces of overconfidence. Social and Personality Psychology Compass, 11(8), 1–12. https://doi.org/10.1111/spc3.12331

Mushinada, V. N. C., & Veluri, V. S. S. (2018). Investors overconfidence behaviour at Bombay stock exchange. International Journal of Managerial Finance, 14(5), 613–632.

Nofsinger, J. R., & Baker, H. K. (2002). Psychological_Biases_of_Investors2002. Financial Service Review, 11, 97–116.

Odean, T. (1999). Do investors trade too much? American Economic Review, 89(5), 1279–1298. https://doi.org/10.2307/j.ctvcm4j8j.28

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies. Journal of Applied Psychology, 88(5), 879–903. https://doi.org/10.1037/0021-9010.88.5.879

Pompian, M. M. (2011). Behavioral Finance and Wealth Management: How to Build Investment (Second (ed.); Second). Wiley.

Price, C. R. (2020). Do women shy away from competition? Do men compete too much?: A (failed) replication. Economics Bulletin, 40(2), 1538–1547. https://doi.org/10.2139/ssrn.1444100

Qadri, S. U., & Shabbir, M. (2014). An Empirical Study of Overconfidence and Illusion of Control Biases, Impact on Investor’s Decision Making: An Evidence from ISE. European Journal of Business and Management, 6(14), 38–44. www.iiste.org

Rasheed, M. H., Rafique, A., Zahid, T., & Akhtar, M. W. (2018). Factors influencing investor’s decision making in Pakistan: Moderating the role of locus of control. Review of Behavioral Finance, 10(1), 70–87. https://doi.org/10.1108/RBF-05-2016-0028

Scott, S. G., & Bruce, R. A. (1995). Decision-Making Style: The Development and Assessment of a New Measure. Educational and Psychological Measurement, 55(5), 818–831. https://doi.org/10.1177/0013164495055005017

Shah, S. Z. A., Ahmad, M., & Mahmood, F. (2018). Heuristic biases in investment decision-making and perceived market efficiency: A survey at the Pakistan stock exchange. Qualitative Research in Financial Markets, 10(1), 85–110. https://doi.org/10.1108/QRFM-04-2017-0033

Shefrin, H. (2002). Behavioral decision making, forecasting, game theory, and role-play. International Journal of Forecasting, 18(3), 375–382. https://doi.org/https://doi.org/10.1016/S0169-2070(02)00021-3

Shefrin, H. (2008). A Behavioral Approach to Asset Pricing, Second Edition. In A Behavioral Approach to Asset Pricing, Second Edition (Second). Elsevier Inc. https://doi.org/10.1016/B978-0-12-374356-5.X5001-3

Simon, H. A. (1955). A behavioral model of rational choice. Quarterly Journal of Economics, 69(1), 99–118. https://doi.org/10.2307/1884852

Skavantzos, A. (1998). Efficient residue to weighted converter for a new Residue Number System. Proceedings of the IEEE Great Lakes Symposium on VLSI, 9(28), 185–191. https://doi.org/10.1109/GLSV.1998.665223

Soll, J. B., & Klayman, J. (2004). Overconfidence in Interval Estimates. Journal of Experimental Psychology: Learning Memory and Cognition, 30(2), 299–314. https://doi.org/10.1037/0278-7393.30.2.299

Statman, M., Thorley, S., & Vorkink, K. (2006). Investor overconfidence and trading volume. Review of Financial Studies, 19(4), 1531–1565. https://doi.org/10.1093/rfs/hhj032

Stulz, R. M. (1995). American Finance Association, Report of the Managing Editor of the Journal of Finance for the Year 1994. The Journal of Finance, 50(3), 1013. https://doi.org/10.2307/2329297

Sudirman, W. F. R., & Pratiwi, A. (2022). Overconfidence Bias Dalam Pengembilan Keputusan Investasi: Peran Perbedaan Gender. Muhammadiyah Riau Accounting and Business Journal, 3(2), 081–092. http://ejurnal.umri.ac.id/index.php/MRABJ

Suryawijaya, M. A. (2003). Ketidakrasionalan Investor di Pasar Modal. Pidato Pengukuhan Jabatan Guru Besar pada Fakultas Ekonomi Universitas Gadjah Mada.

Trinugroho, I., & Sembel, R. (2011). Overconfidence and excessive trading behavior: An experimental study. International Journal of Business and Management, 6(7), 147.

Waweru, N. M., Munyoki, E., & Uliana, E. (2008). The effects of behavioural factors in investment decision-making?: a survey of institutional investors operating at the Nairobi Stock Exchange. Int. J. Business and Emerging Markets, 1(1), 24–41.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Wahyu Febri Ramadhan Sudirman, Nurnasrina Nurnasrina, Muhammad Syaipudin, Arif Mudi Priyatno

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.