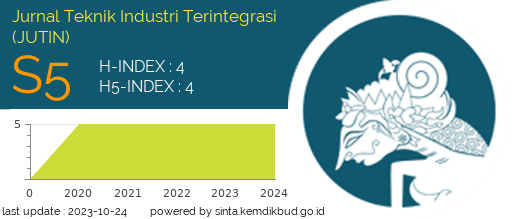

Analisis Kelayakan Investasi Mesin Pencetak Adonan Guna Meningkatan Kapasitas Produksi pada UMKM Nek Wik di Bawean

DOI:

https://doi.org/10.31004/jutin.v7i1.21706Keywords:

Feasibility Analisis , NPV , IRR , Payback Period , Profitability IndexAbstract

UMKM Nek Wik is an UMKM that operates in the food sector, namely producing posot-posot which is a typical cracker from Bawean Island. In the production process, there is a process that is still done manually, namely the dough molding process, which takes a long time, making production slow and production targets and demand are sometimes not met, therefore it is necessary to procure a dough molding machine to speed up the production process and meet targets and consumer demands. With the addition of this dough molding machine, an investment feasibility analysis is needed to find out whether this dough molding machine is worth investing in or not. Based on the results of the analysis of the feasibility of investing in a dough molding machine at Nek Wik MSMEs, the following conclusion was obtained: from the calculation of the Net Present Value (NPV) a positive result of IDR was, which means NPV>0 so it is worth investing. From the results of the Internal Rate of Return calculation, a result of 43.45% was obtained, where this result was greater than the initial interest rate, namely 9.08%, so the investment was worth implementing. From the results of the Payback Period calculation, the investment value for the machine is 8.36 months or 251 days, meaning that because the payback period is less than the economic life of 5 years, the investment is feasible. From the results of the Profitability Index calculation, it is 1.43, which means the PI value is> 1, so the investment in purchasing a dough molding machine is feasible.References

Abuk, G. M., & Rumbino, Y. (2020). Analisis kelayakan ekonomi menggunakan metode Net Present Value (NPV), metode Internal Rate of Return (IRR) Payback Period (PBP) pada unit Stone Crusher di CV. X Kab. Kupang Prov. NTT. Jurnal Ilmiah Teknologi FST Undana, 14(2), 68–75.

Citrasari, G., Imam, S., Studi, P., Industri, T., Kemasan, C., Grafika, J. T., Penerbitan, D., Jakarta, N., Prof, J., Siwabessy, D. G. A., Beji, K., & Depok, K. (2021). Analisa Kelayakan Investasi Penggantian Mesin Bag Making Di Pt X. Journal Printing and Packaging Technology, 2(1), 2021.

Giatman, M. (2011). EKONOMI TEKNIK (3rd ed.). PT.Raja Grafindo Persada.

Khoiroh, S. M., Mundari, S., Sofianto, R., & Septiana, A. (2019). Pengaruh Digital Marketing, Profitability, Literasi Keuangan, Dan Pendapatan Terhadap Keputusan Investasi Lat (Lobster Air Tawar) Di Indonesia. Teknika: Engineering and Sains Journal, 3(2), 71. https://doi.org/10.51804/tesj.v3i2.473.71-76

Kusuma, P. T. W. . (2012). Analisis Kelayakan Finansial Pengembangan Usaha Kecil Menengah (UKM) Nata De Coco Di Sumedang, Jawa Barat. Jurnal Inovasi Dan Kewirausahaan, 1(2), 113–120.

Prihastono, E., & Hayati, E. (2015). Analisis Kelayakan Investasi Mesin untuk Meningkatkan Kapasitas Produksi (Studi Kasus di CV Djarum Mulia Embroidery Semarang). Jurnal Dinamika Teknik, 9(2), 47–60.

Pujawan, I. N. (2019). EKONOMI TEKNIK (L. Mayasari (ed.); Edisi 3). LAUTAN PUSTAKA.

Zaini, A., Wati, P. E. D. K., & Riyadi, S. (2023). Vol 1 No 1 ( 2023 ) ANALISIS KELAYAKAN INVESTASI ALAT ROLL STREAPING PADA UKM MEKAR HANDCRAFT Ahmad Zaini Putu Eka Dewi Karunia Wati Universitas 17 Agustus 1945 surabaya , [email protected] Slamet Riyadi Universitas 17 Agustus 1945 surabaya , sla. 1(1), 136–146.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Syamsul Bahri, Putu Eka Dewi Karunia Wati

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.