ANALISIS FAKTOR INTERNAL YANG MEMPENGARUHI PROFITABILITAS BANK KONVENSIONAL

DOI:

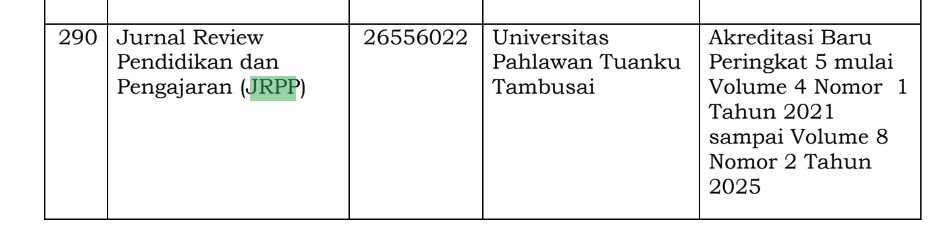

https://doi.org/10.31004/jrpp.v7i3.31049Keywords:

LDR, NIM, BOPO, ProfitabilitasAbstract

The purpose of this study is to determine the effect of Loan Deposit Ratio (LDR), Net Interest Margin (NIM), and Operational Income Operating Costs (BOPO) on Return on Assets (ROA) in conventional banking sector companies in Indonesia, using 5 banks with financial reports from 2018 to 2022 and complete data on the variables studied. E-Viws 12 technical analysis entails picking a panel data model (common effect, fixed effect, and random effect) and then running a panel data test. According to the findings of the analysis, the net interest margin (NIM) and Operational Income Operating Costs (BOPO) have a partial effect on ROA, however the loan deposit ratio (LDR) has no partial effect on ROA. The elements Loan Deposit Percentage.References

Cahyani, L. S., Tripuspitorini, F. A., & Nurdin, A. A. (2022). Pengaruh CAR, LDR dan NIM Terhadap ROA Pada Bank Umum Yang Terdaftar di BEI. Indonesian Journal of Economics and Management, 379 – 387.

Dietrich, A., & Wanzenried, G. (2011). Determinants of bank Profitability Before and During . Journal of International Financial Markets, Institutions and Money, 307-327.

Eng, T. (2011). . Influence of NIM, BOPO, LDR, NPL and CAR Against ROA of International Bank and National Bank Go Public Period 2007-2011. Jurnal Dinamika Manajeme, 153–167.

Ghozali, I. (2018). . Aplikasi Analisis Multivariate dngan Program IBM SPSS 25 (Ed. 9). Semarang: BP Universitas Diponegoro.

Gujarati, D., & Porter, D. C. (2012). Essentials of Econometrics (5th ed.). NY: McGraw-Hill Education.

Hasibuan, M. (2006). Manajemen Sumber Daya Manusia. Jakarta: Bumi Aksara.

Kasmir. (2014). Analisis Laporan Keuangan. Jakarta: PT. Raja Grafindo Persada.

Monoarf, A., Murni, S., & Untu, V. N. (2020). FAKTOR-FAKTOR YANG MEMPENGARUHI ROA STUDI KASUS PADA BANK UMUM SYARIAH YANG TERDAFTAR DI BEI PERIODE 2014-2019. Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 389-399.

Nurfitriani, I. (2021). The Influence of Capital Adequacy Ratio (CAR), Non Peforming Loan (NPL), and Loan to Deposit Ratio (LDR) to Return on Asset (ROA) at the Bank Muamalat Indonesia. Jurnal At-Tamwil, 50–67.

Pandia, F. (2012). Manajemen Dana dan Kesehatan Bank. Jakarta: Rineka Cipta.

Pratama, M. S., Afriansyah, R., & Mubaroh, S. (2022). Analisis kinerja keuangan menggunakan regresi data panel pada sektor perbankan di Indonesia. INOVASI: Jurnal Ekonomi, Keuangan dan Manajemen, 686-692.

Rachmawati, T. (2009). Pengaruh Return on Assets (ROA), Return on Equity (ROE), Net Interest Margin (NIM) dan Rasio Biaya Operasional Pendapatan Operasional (BOPO) terhadap Harga Saham Bank di Bursa Efek Indonesia. DIE: Jurnal Ilmu Ekonomi dan Manajemen, 67–94.

Setiawan, A. (2017). Analisis Pengaruh Tingkat Kesehatan Bank terhadap Return on Asset. Jurnal Akuntansi Dewantara Universitas Sarjanawiyata Tamansiswa,, 138-151.

Soares, P., & Yunanto. (2018). The Effect of NPL, CAR, LDR, OER and NIM to Banking . International Journal of Economics, Commerce and Management, 40-55.

Spence, M. (1973). Market Signaling. The Quertely Journal of Economics, 355-374.

Subandi, & Ghozali, I. (2014). An Efficiency Determinant of Banking Industry in Indonesia. Research Journal of Finance and Accounting, 18–26.

Subramanyam, K. R., & Wild, J. J. (2010). Financial Statement Analysis. New York: Mc-Graw Hill International.

Widyastuti, P. F., & Aini, N. (2021). PENGARUH CAR, NPL, LDR TERHADAP PROFITABILITAS BANK (ROA) Tahun 2017-2019. JIMAT (Jurnal Ilmiah Mahasiswa Akuntansi) Universitas Pendidikan Ganesha, 2614 – 1930.

Wijono, D., Dwiyanto, B. S., Jemadi, & Risdwiyanto, A. (2023). Pengaruh ROA, NIM, dan BOPO terhadap Harga Saham Perbankan LQ20 di Bursa Efek Indonesia Periode 2016-2022 Menggunakan Analisis Data Panel. Jurnal Maksipreneur: Manajemen, Koperasi, dan Entrepreneurship, 632 – 646.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Khairani Alawiyah Matondang, Meisha Fatma Wijaya, Siti Alifah Handayani, Tessalonika Federova Br Simanjuntak

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.