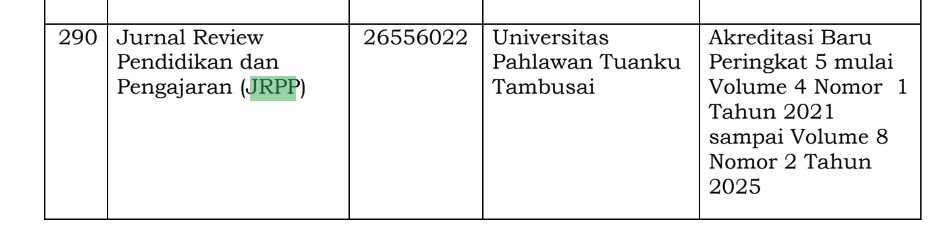

ANALISIS PUSTAKA TENTANG KEBIJAKAN DIVIDEN

DOI:

https://doi.org/10.31004/jrpp.v7i1.25798Keywords:

ividen; Systematic Literature Review; PerusahaanAbstract

Faktor-faktor penentu kebijakan dividen telah diteliti selama beberapa dekade, namun belum ada konsensus mengenai faktor-faktor mana yang memengaruhi kecenderungan membayar dividen dan pembayaran dividen. Artikel ini merupakan tinjauan literatur tentang dividen. Tujuan penelitian ini adalah untuk memberikan tinjauan literatur yang mendalam tentang dividen di perusahaan. Penelitian ini menggunakan 58 artikel sebagai bahan kajian. Hasil penelitian menunjukkan variabel-variabel yang mempengaruhi maupun dipengaruhi dividen. Penelitian ini tidak menemukan dividen sebagai variabel moderasi maupun mediasi. Variabel yang diidentifikasi dalam penelitian ini merupakan variabel internal dan eksternal perusahaan.References

Abor, J. and Bokpin, G.A. (2010), “Investment opportunities, corporate finance, and dividend payout policy”, Studies in Economics and Finance, Vol. 27 No. 3, pp. 180-194.

Acharya, Viral V., Le, Hanh., dan Shin, Hyun Song. (2016). Bank Capital and Dividend Externalities. The Review of Financial Studies.

Adam, Klaus., Marcet, Albert., dan Nicolini, Juan Palbo. (2016). Stock Market Volatility and Learning. The Journal of Finance. DOI: 10.1111/jofi.12364

Al-Ajmi, J. and Hussain, H.A. (2011), “Corporate dividends decisions: evidence from Saudi Arabia”, Journal of Risk Finance, Vol. 12 No. 1, pp. 41-56.

Al-Kayed, L.T. (2017), “Dividend payout policy of Islamic vs conventional banks: case of Saudi Arabia”, International Journal of Islamic and Middle Eastern Finance and Management, Vol. 10 No. 1, pp. 117-128.

Al-Malkawi, H.A.N. (2007), “Determinants of corporate dividend policy in Jordan: an application of the Tobit model”, Journal of Economic and Administrative Sciences, Vol. 23 No. 2, pp. 44-70.

Anantavrasilp, Sereeparp., de Jong, Abe., DeJong, Douglas V., dan Hege, Ulrich. (2019). Blockholder leverage and payout policy: Evidence from French holding companies. Journal of Business Finance & Accounting. DOI: 10.1111/jbfa.12415

Anderson, Warwick., Bhattacharyya, Nalinaksha., Morrill, Cameron., dan Roberts, Helen. (2018). Dividend payout and executive compensation: theory and evidence from New Zealand. Accounting & Finance. DOI: 10.1111/acfi.12399

Arko, A.C., Joshua, A., Charles, K.D.A. and Amidu, M. (2014), “What influence propensity to pay dividends of firms in Sub-Saharan African?”, Journal of Accounting in Emerging Economies, Vol. 4 No. 1, pp. 57-78.

Athari, Seyed Alireza., Adaoglu, Cahit., dan Bektas, Eralp. (2016). Investor protection and dividend policy: The case of Islamic and conventional banks. Emerging Markets Review. DOI: 10.1016/j.ememar.2016.04.001

Baker, Malcolm., Mendel, Brock., dan Wurgler, Jeffrey. (2015). Dividends as Reference Points: A Behavioral Signaling Approach. The Review of Financial Studies. DOI:10.1093/rfs/hhv058

Balachandran, Balasingham., dan Nguyen, Justin Hung. (2018). Does Carbon Risk Matter in Firm Dividend Policy? Evidence from a Quasi-natural Experiment in an Imputation Environment. Journal of Banking and Finance. DOI: 10.1016/j.jbankfin.2018.09.015

Belo, Frederico., Collin-Dufresne, Pierre., dan Goldstein., Robert S. (2015). Dividend Dynamics and the Term Structure of Dividend Strips. The Journal of Finance. DOI: 10.1111/jofi.12242

Berzins, Janis., Bøhren, Øyvind., dan Stacescu, Bogdan. (2019). Dividends and taxes: The moderating role of agency conflicts. Journal of Corporate Finance. DOI: 10.1016/j.jcorpfin.2019.07.003

Bessembinder, Hendrik., Cooper, Michael J., dan Zhang, Feng. (2018). Characteristic-Based Benchmark Returns and Corporate Events. The Review of Financial Studies. DOI:10.1093/rfs/hhy037

Bhattacharyaa, Debarati., Chang, Chia-Wen., dan Li, Wei-Hsien. (2019). Stages of firm life cycle, transition, and dividend policy. Finance Research Letters. DOI: 10.1016/j.frl.2019.06.024

Botoc, C. and Pirtea, M. (2014), “Dividend payout-policy drivers: evidence from emerging countries”, Emerging Markets Finance and Trade, Vol. 50 No. 4, pp. 95-112.

Buchanan, Bonnie., Cao, Cathy Xuying., Liljeblom, Eva., dan Weihrich, Susan. (2016). Uncertainty and firm dividend policy—A natural experiment. Journal of Corporate Finance. DOI: 10.1016/j.jcorpfin.2016.11.008

Carlson, Murray., Chapman, David A., Kaniel, Ron., dan Yan, Hong. (2016). Specification Error, Estimation Risk, and Conditional Portfolio Rules. International Review of Finance. DOI: 10.1111/irfi.12110

Chan, Kam Fong., Powell, John G., Shi, Jing., dan Smith, Tom. (2016). Dividend persistence and dividend behaviour. Accounting & Finance. 10.1111/acfi.12208

Chen, Ester., dan Gavious, Ilanit. (2016). Unrealized earnings, dividends and reporting aggressiveness: an examination of firms’ behavior in the era of fair value accounting. Accounting & Finance. DOI: 10.1111/acfi.12187

Chen, Fan. (2016). The wealth effects of dividend announcements on bondholders: New evidence from the over-the-counter market. Journal of Economics and Business. DOI: 10.1016/j.jeconbus.2016.04.003

Chen, Hang., Zhu, Yushu., dan Chang, Liang. (2017). Short-selling constraints and corporate payout policy. Accounting & Finance. DOI: 10.1111/acfi.12314

Chen, Jie., Leung, Woon Sau., dan Goergen, Marc. (2017). The impact of board gender composition on dividend payouts. Journal of Corporate Finance. DOI: 10.1016/j.jcorpfin.2017.01.001

Cheng, Zijian., Cullinan, Charles P., Liu, Zhangxin (Frank)., dan Zhang, Junrui. (2019). Cross-listings and dividend size and stability: evidence from China. Accounting & Finance. DOI: 10.1111/acfi.12579

Cheung, Adrian (Waikong)., Hu, May., Schweibert, Jorg. (2016). Corporate social responsibility and dividend policy. Accounting & Finance. DOI: 10.1111/acfi.12238

Chintrakarn, Pandej., Tong, Shenghui., Jiraporn, Pornsit., dan Kim, Young Sang. (2020). Using Geographic Density of Firms to Identify the Effect of Board Size on Firm Value and Corporate Policies. Asia Pacific Journal of Financial Studies. DOI: 10.1111/ajfs.12285

Coculescu, Delia., dan Rochet, Jean?Charles. Shareholder Risk Measures. Mathematical Finance. DOI: 10.1111/mafi.12142

Cooper, Ian A., dan Lambertides, Neophytos. (2017). Large dividend increases and leverage. Journal of Corporate Finance. DOI: 10.1016/j.jcorpfin.2017.10.011

Crane, Alan D., Michenaud, Sebastien., Weston, James P. (2016). The Effect of Institutional Ownership on Payout Policy: Evidence from Index Thresholds. The Review of Financial Studies. DOI:10.1093/rfs/hhw012

De Angelo, H., DeAngelo, L. and Stulz, R. (2006), “Dividend policy and the earned/contributed capital mix: a test of the lifecycle theory”, Journal of Financial Economics, Vol. 8 No. 1, pp. 227-254.

Dempsey, Michael., Gunasekarage, Abeyratna., Truong. (2018). The association between dividend payout and firm growth: Australian evidence. Accounting & Finance. DOI: 10.1111/acfi.12361

Denis, J.D. and Osobov, I. (2008), “Why do firms pay dividends? International evidence on the determinants of dividend policy”, Journal of Financial Economics, Vol. 89 No. 1, pp. 62-82.

Dewasiri, N. Jayantha., Koralalage, Weerakoon Banda Yatiwelle., Azeez, Athambawa Abdul., Jayarathne, P.G.S.A., Kuruppuarachchi, Duminda., Weerasinghe, V.A. (2019) "Determinants of dividend policy: evidence from an emerging and developing market", Managerial Finance, https://doi.org/10.1108/MF-09-2017-0331

Driver, Ciaran., Grosman, Anna., dan Scaramozzino, Pasquale. (2019). Dividend policy and investor pressure. Economic Modelling. DOI: 10.1016/j.econmod.2019.11.016

Duqi, Andi., Jaafar, Aziz., dan Warsame, Mohammed H. (2019). Payout policy and ownership structure: The case of Islamic and conventional banks. The British Accounting Review. DOI: 10.1016/j.bar.2019.03.001

Duygun, Meryem., Guney, Yilmaz., dan Moin, Abdul. (2018). Dividend policy of Indonesian listed firms: The role of families and the state. Economic Modelling. DOI: 10.1016/j.econmod.2018.07.007

Fama, E. and French, K. (2001), “Disappearing dividends: changing firm characteristics or lower propensity to pay?”, Journal of Financial Economics, Vol. 60 No. 1, pp. 3-43.

Fama, E and French, K. (2002), “Testing trade off and pecking order predictions about dividends and debt?”, The Review of Financial Studies, Vol. 15 No. 1, pp. 1-33.

Fernau, Erik., dan Hirsch, Stefan. (2018). What drives dividend smoothing? A meta regression analysis of the Lintner model. International Review of Financial Analysis. DOI: 10.1016/j.irfa.2018.11.011

Fuller, Kathleen P., dan Yildiz, Serhat. (2018). Managerial Learning Through Customer–Supplier Links. The Journal of Financial Research. DOI: 10.1111/jfir.12161

Golubov, Andrey., Lasfer, Meziane., dan Vitkova, Valeriya. (2020). Active catering to dividend clienteles: Evidence from takeovers. Journal of Financial Economics. DOI: 10.1016/j.jfineco.2020.04.002

Grennan, Jillian. (2018). Dividend payments as a response to peer influence. Journal of Financial Economics. DOI: 10.1016/j.jÞneco.2018.01.012

Ham, Charles., Kaplan, Zachary., dan Leary, Mark T. (2019). Do dividends convey information about future earnings? Journal of Financial Economics. DOI: 10.1016/j.jfineco.2019.10.006

Harris, Lawrence E., Hartzmark, Samuel M., dan Solomon, David H. (2015). Juicing the dividend yield: Mutual funds and the demand for dividends. Journal of Financial Economics. DOI: 10.1016/j.jfineco.2015.04.001

Hartzmark, Samuel M., dan Solomon, David H. (2019). The Dividend Disconnect. The Journal of Finance. DOI: 10.1111/jofi.12785

Hasan, Mostafa Monzur., dan Habib, Hasan. (2020). Social capital and payout policies. Journal of Contemporary Accounting and Economics. DOI: 10.1016/j.jcae.2020.100183

He, Jie., Tian, Xuan., Yang, Huan., dan Zuo, Luo. (2020). Asymmetric Cost Behavior and Dividend Policy. Journal of Accounting Research. DOI: 10.1111/1475-679X.12328

He, Zhong., Chen, Xiaoyan., Huang, Wei., Pan, Rulu., Shi, Jing. (2016). External finance and dividend policy: a twist by financial constraints. Accounting & Finance. DOI: 10.1111/acfi.12245

Hu, May., Tuilautala, Mataiasi., dan Kang, Yuni. (2019). Bandwagon effect: Special dividend payments. International Review of Economics and Finance. DOI: 10.1016/j.iref.2019.04.002

Imamah, Nur., Lin, Tsui-Jung., Suhadak., Handayani, Siti Ragil., dan Hung, Jung-Hua. (2019). Islamic law, corporate governance, growth opportunities and dividend policy in Indonesia stock market. Pacific-Basin Finance Journal. DOI: 10.1016/j.pacfin.2019.03.008

Jacob, Martin., dan Michaely, Roni. (2017). Taxation and Dividend Policy: The Muting Effect of Agency Issues and Shareholder Conflicts. The Review of Financial Studies. DOI: 10.1093/rfs/hhx041

Jagannathan, Ravi., dan Liu, Binying. (2018). Dividend Dynamics, Learning, and Expected Stock Index Returns. The Journal of Finance. DOI: 10.1111/jofi.12731

Jia, Zi Tingting., dan McMahon, Matthew J. (2019). Dividend payments and excess cash: an experimental analysis. Journal of Behavioral and Experimental Economics. DOI: 10.1016/j.socec.2019.101458

Jiang, Hao., dan Sun, Zheng. (2019). Reaching for dividends. Journal of Monetary Economics. 10.1016/j.jmoneco.2019.08.003

Juelsrud, Ragnar E., dan Nenov, Plamen T. (2019). Dividend Payouts and Rollover Crises. The Review of Financial Studies. DOI: 10.1093/rfs/hhz130

Khokhar, Abdul-Rahman., dan Sarkar, Sudipto. (2019). Market response to dividend change announcements: unregulated versus regulated US firms. Accounting & Finance. DOI: 10.1111/acfi.12512

Kuo, Liang-wei. (2017). Reputation as a governance mechanism? Evidence from payout policy of insider?controlled firms in Taiwan. Journal of Business Finance & Accounting. DOI: 10.1111/jbfa.12261

Kuzucu, N. (2015), “Determinants of dividend policy: a panel data analysis for Turkish listed Firms”, International Journal of Business and Management, Vol. 10 No. 11, pp. 149-160.

Lai, Karen M.Y., Saffar, Walid., Zhu, Xindong (Kevin)., dan Liu, Yiye. (2019). Political institutions, stock market liquidity and firm dividend policy: Some international evidence. Journal of Contemporary Accounting and Economics. DOI: 10.1016/j.jcae.2019.100180

Lee, Bong Soo., dan Mauck, Nathan. (2016). Dividend initiations, increases and idiosyncratic volatility. Journal of Corporate Finance. DOI: 10.1016/j.jcorpfin.2016.07.005

Li, Jun., dan Zhang, Harold H. (2016). Short-Run and Long-Run Consumption Risks, Dividend Processes, and Asset Returns. The Review of Financial Studies. DOI: 10.2139/ssrn.2269883

Li, Wanli., Zhou, Jingting., Yan, Ziqiao, dan Zhang, He. (2019). Controlling shareholder share pledging and firm cash dividends. Emerging Markets Review. DOI: 10.1016/j.ememar.2019.100671

Lin, H. C., Han, X., Lyu, T., Ho, W. H., Xu, Y., Hsieh, T. C., Zhu, L., & Zhang, L. (2020). Task-technology fit analysis of social media use for marketing in the tourism and hospitality industry: a systematic literature review. International Journal of Contemporary Hospitality Management, 32(8), 2677–2715. https://doi.org/10.1108/IJCHM-12-2019-1031

Lintner, J. (1956), “Distribution of incomes of corporations among dividends, retained earnings and taxes”, American Economic Review, Vol. 46 No. 2, pp. 97-113.

Lozano, Maria Belen., Lopez-Iturriaga, Felix J., and Braz-Bezerra, Victor Hugo. (2019). Regulatory Dualism as an Alternative Trust-Enhancing Mechanism for Dividends and Debt: Evidence from Brazil. International Review of Finance. DOI: 10.1111/irfi.12259

Marfe, Roberto. (2017). Income Insurance and the Equilibrium Term Structure of Equity. The Journal of Finance. DOI: 10.1111/jofi.12508

Michayluk, David., Neuhauser, Karyn., dan Walker, Scott. (2017). Are all dividends created equal? Australian evidence using dividend-increase track records. Accounting & Finance. DOI: 10.1111/acfi.12303

Ni, Xiaoran., dan Zhang, Huilin. (2019). Mandatory corporate social responsibility disclosure and dividend payouts: evidence from a quasi-natural experiment. Accounting & Finance. DOI: 10.1111/acfi.12438

Patra, T., Poshakwale, S. and Kean Ow-Yong (2012), “Determinants of corporate dividend policy in Greece”, Applied Financial Economics, Vol. 22 No. 13, pp. 1079-1087

Perretti, G.F., Allen, M.T. and Weeks, H.S. (2013), “Determinants of dividend policies for ADR firms”, Managerial Finance, Vol. 39 No. 12, pp. 1155-1168.

Singh, A., Kumar, S., Goel, U., & Johri, A. (2023). Behavioural biases in real estate investment: a literature review and future research agenda. Humanities and Social Sciences Communications, 10(1), 846. https://doi.org/10.1057/s41599-023-02366-7

Smith, Deborah Drummond., Pennathur, Anita K., dan Marciniak, Marek R. (2017). Why do CEOs agree to the discipline of dividends? International Review of Financial Analysis. DOI: 10.1016/j.irfa.2017.04.010

Wei, Xiaoting., Truong, Cameron., dan Do, Viet. (2019). When are dividend increases bad for corporate bonds? Accounting & Finance. DOI: 10.1111/acfi.12441

Wu, Yufeng. (2017). What’s behind Smooth Dividends? Evidence from Structural Estimation. The Review of Financial Studies. DOI: 10.1093/rfs/hhx119

Ye, Dezhu., Deng, Jie., Liu, Yi., Szewczyk, Samuel H., dan Chen, Xiao. (2019). Does board gender diversity increase dividend payouts? Analysis of global evidence. Journal of Corporate Finance. DOI: 10.1016/j.jcorpfin.2019.04.002

Yusof, Y. and Ismail, S. (2016), “Determinants of dividend policy of public listed companies in

Malaysia”, Review of International Business and Strategy, Vol. 26 No. 1, pp. 88-99.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Bhenu Artha

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.